More shipping companies have committed to accelerate their plans towards a carbon-neutral future, while vessels calling at ports in South Korea and the United States have two years to adapt to new emissions control rules

Tightening timelines towards carbon-neutral shipping

SPEAKING to Lloyd’s List last week, Berge Bulk chief executive James Marshall says the company intends to get its 75 vessels to become a carbon-neutral fleet by the end of 2025.

Berge Bulk has long been among the advance guard of operators positioning their efficiency credentials as a strategic pillar of their operations, swimming against the tide of charterers’ general unwillingness to pay for quality. It was an early member of the Get to Zero coalition and its Blue Matters environmental programme has won its plaudits a plenty, not least in the form of Lloyd’s List Award.

But the pace by which it has achieved many of its environmental targets has left others in the industry looking like laggards.

“Our efficiency gains are running at over 40% compared to 2008 when we started the business,” Mr. Marshall explained speaking on the Lloyd’s List Podcast. “We have actually matched the IMO’s 2030 targets today in 2020, so real achievements have been made and we have done that by building bigger and better ships, a lot of retrofits to our existing ships, and also improving efficiency through operations dramatically.”

Mr. Marshall is confident that he can extract a further efficiency saving of 20%-30% via existing technology currently being tested and a concept ship Berge Bulk has in the works that come bristling with every conceivable trial kit from wind kites and solar to onboard carbon capture.

Oslo-based scrubber manufacturer Yara Marine Technologies, meanwhile, is looking to the next generation of green technology and has launched a competition offering office space, mentoring, a $10,000 grant and possible investment to a young company or individual with ideas that can make the industry more environmentally sustainable.

Piloting and distribution opportunities with Yara Marine customers, suppliers, and network are part of the longer-term plan. Key markets for the new technologies will be Asia, the Americas, and Europe.

“We will be recruiting young companies or professionals with a focus on sustainability and green solutions within vessel operations,” said YMT strategy business development manager Thomas Gabestad.

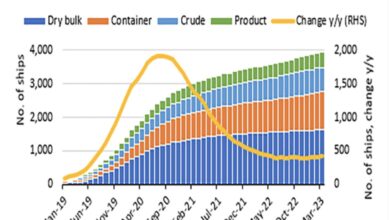

Scrubber installations

A recent ban on the use of open-loop scrubbers by Saudi Arabia has added to the fragmented regulatory landscape around the use of the controversial technology, but that has not translated into a shift within the market for scrubbers, Lloyd’s List has learned.

The open-loop exhaust gas cleaning system accounts for 70% of all scrubbers fitted globally but they continue to face resistance from certain coastal jurisdictions over concerns around the impact of wash water discharge on marine environments.

With the prohibitions growing and clarity lacking, there would be an expectation that shipowners would look at alternatives, but this has not happened, according to Jan Othman, exhaust treatment vice-president at Wärtsilä Marine, the world’s largest scrubber manufacturer.

While there has been an uptick in inquiries for hybrid and closed-loop systems, this has yet to translate into a rise in orders. “When it comes to actual contracting we have not really seen any major changes yet. It has been the same as it has for the past few years,” he told Lloyd’s List.

Traditionally, containerships, ferries, and cruise ships have sought out hybrid and closed-loop scrubbers, while the tramp trading bulkers and tankers have opted for open loop, Mr. Othman said.

Emissions reductions

Finally, South Korea is to tighten its Sulphur cap for ships calling at six ports in the country as well as neighboring waters.

A 0.1% sulphur limit in marine fuels onboard ships in designated emissions control areas, or SECAs, is to be rolled out across the ports of Incheon, Pyeongtaek-Dangjin, Yeosu, Gwangyang, Busan, and Ulsan and their nearby water, a statement from the Korean Register said.

Ships will initially be required to switch to 0.1% sulphur fuels within one hour of anchoring and mooring in these areas. They will have to continue burning such compliant fuels for up to one hour before completing heaving in anchor or de-berthing.

The full regulatory cap will come into force from January 1, 2022, when ships have to burn compliant fuels on entering and until departing the SECAs.

Oceangoing ships have also been targeted for emissions reductions in the US state of California. The California Air Resources Board approved new regulations aimed at decreasing air pollution and will apply to vessels docked at the state’s busiest ports.

The new ruling for ships requires that every vessel coming into a regulated California port either uses shore power or Carb-approved control technology to reduce harmful emissions.

The existing regulation will stay in effect through 2022, while the updated regulation starts in 2023 when container, reefer, and cruise vessels included under the existing rule transition to the new one.

Vehicle carriers must comply starting in 2025. Tankers docking at the ports of Los Angeles and Long Beach must also comply starting in 2025, while tankers in northern California have until 2027.