What remains to be seen is to what extent the Russian hydrocarbon industry will utilize Russian flagged or sponsored and Russian insured vessels. ?!

By : Nadir Mumtaz

Worldwide countries maintain fleets in the Public or Private sector or hybrid depending on the geography and craving of sovereign assertiveness.

Cargo preferential treatments are influential instruments of economic cartelization . Yet such policies can have an adverse effect on the nation’s economy by increasing the cost of transport and creating an inefficient and rigid shipping structure due to the lack of competition.

Competitive Environment

The present competitive shipping environment is exerting pressure on national flag carriers to match rates offered by foreign competitors. Consigners aware about prevailing freight rates demand comparative rates from the national flag carriers to remain internationally competitive.

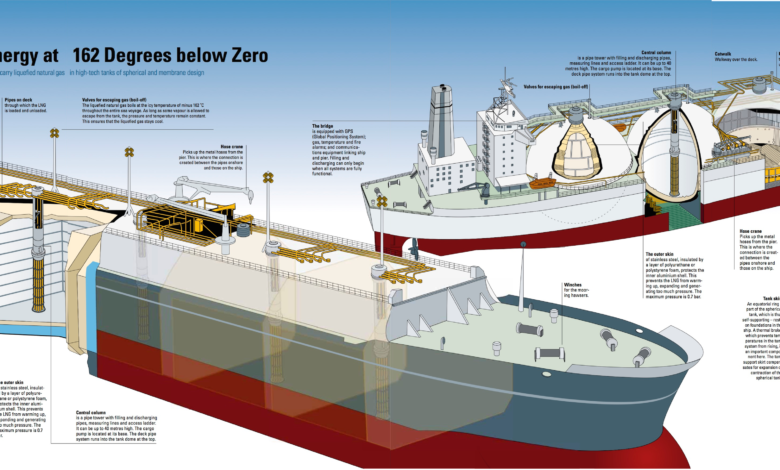

Shipping lines catering to the LNG trade are invariably hesitant to place fresh orders for a LNG tanker with ship building cost of more than US $ 100 million unless there is an assurance of a longterm contract supported by sovereign guarantee.

Cabotage regimes

The USA is a vivid instance of cabotage regime. The Jones Act and associated legislation require that ships used to carry cargoes between ports in the USA must be owned by USA citizens, built in USA shipyards and manned by USA crews.

The cabotage debate, i.e. should cabotage be retained is vociferous in developed countries where the cost of national shipping is high relative to the world fleet and domestic shippers can perceive an economic advantage from access to lower cost shipping services.

The debate is particularly vigorous in countries such as the USA and Australia with large coast lines and substantial coastal freight tasks.

Long Coastlines

While Australia is endowed with national resources for steel production most of its coal is on its east coast and the iron ore is thousands of kilometers away on the west coast.

Recourse to coastal shipping is a cost effective meachanism to transport such commodities in bulk . Dry bulk cargoes in the form of iron ore, coal and bauxite account for around 60% of Australia’s coastal cargoes.

Taxation as Impediment to Shipping Industry

Taxation statutes may require the payment of commercial taxation on income or may bring the ship within the liability of local indirect taxes such as fuel excise. Any of these areas of law individually or in combination can act as an impediment to foreign shipping engaging in coastal trades.

Diversity in Shipping Lines is elaborated below ;

- The National Shipping Company of Saudi Arabia was established as a public company with the brand identity of Bahri. Operations sectors include oil & gas, dry bulk and general cargo shipping inherently integral to Saudi Vision 2030 aimed to transform the Kingdom into a key strategic regional hub and logistics gateway across three continents. A fleet of 95 state-of-the-art vessels including 39 VLCC’s and 28 chemical tankers enable Bahri to serve 150 ports worldwide,.

- P. Moller-Maersk is the world’s largest integrated shipping company with a total capacity of 4.1m TEU’s operating a fleet of 708 vessels. Maersk is the maritime division of Denmark’s A.P. Moeller-Maersk A/S a global leader in container shipping and port management and owns more than 70 container terminals.

- China Ocean Shipping Company (COSCO) Shipping Lines a fully owned subsidiary of China’s state-owned shipping giant Cosco Shipping Holding operates 507 container vessels with a combined capacity of approximately 3.1m TEU’s serving 401 international and domestic shipping routes.

- French container shipping company CMA CGM Group operates a fleet of 502 container vessels with a total capacity of 2.7m TEU’s.

On the other end of the spectrum South Africa’s coastline stretches more than 3,000 km and despite its strategic location along the North/South and East/West trade corridors does not have its own national shipping line at least not after Maersk acquired the South African shipping line Safmarine. South Africa remains reliant on foreign flagged shipping lines for its external trade.

Phantom Fleets taking up the slack

Ominously the new Russian maritime doctrine in concert with the 2021 National Security Strategy of the Russian Federation considers itself in direct confrontation with the West or a “total hybrid war with the Collective West .”

Phantom fleets have unobtrusively entered the void created by sanctions. Russian exporters of oil and gas are apparently entering the realm of deploying or resorting to phantom fleets.

The ongoing debate of national fleets versus private shipping lines is seemingly becoming irrelevant in the perspectives of rise of phantom fleets. Though small and disorganized the phantom ships may become increasingly ships of choice for transporting Russian fuel and hazardous cargoes.

Russia has been relatively successful in evading of US and EU sanctions and in acquiring revenues from crude exports through utilization of phantom fleets from Greece and a motley collection of unregistered ships. Commencing 5th of December 2022 and 5th February 2022 the sanctions on exports of Russian crude and refined petroleum products respectively come into effect which is anticipated to have a crippling impact on Russia’s export of crude.

It is likely that Russian exporters will increase reliance on a rapidly expanding ghost fleet that as the term implies has no formal existence and tracing the clandestine route is complex.

This informal transport mechanism traditionally deals in banned exports of Iranian, Venezuelan and North Korean commodities.

Routes and Rouge Vessels

In the year 2022 Lloyd’s List Intelligence which monitors global shipping detected an aberration in the shipping pattern at the Russian ports of Ust-Luga, Primorsk, Novorossiysk and St. Petersburg.

Its preliminary analysis revealed that in one month out of 204 crude tankers sailing from these ports 58 belonged to Sovcomflot the Russian shipping giant.

Intriguingly 79 oil tankers were registered in Greece and the cargo destination was predominantly bound to the ports of India, Turkey, UAE and China instead of the pre sanctions destinations in North America and Western Europe .

Russian oil was loaded by smaller tankers traveling from the Black Sea ports of Novorossiysk, Tuapse, and Taman into oil tankers sailing from the Greek city of Kalamata and the Maltese cities of Marsaxlokk and Marsaskala .

The dynamics will change on 5th December when the EU’s ban on Russian crude comes into effect and 5th February 2023 when the ban on refined Russian petroleum products commences.

These bans may hasten the trend of induction of phantom vessels and unlike the officially existing vessels registered in a flag state such as Panama, Liberia or the Marshall Islands with formally assigned International Maritime Organization tracking numbers the phantom vessels are not registered with a flag state and are bereft of commercial insurance reflective of the profits in subterfuge maritime transport.

Subterfuge Refined

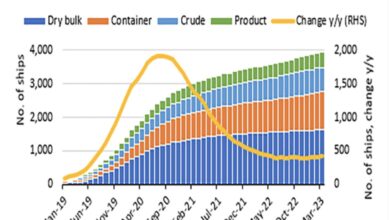

These phantom oil tankers number around 200 , thrice as more then existed in February 2022, and employ antics of switching off their Artificial Intelligence System and go off grid remerging at other locations after carrying out their Sea to Sea loading. Certain port authorities consent to the documents being commercially advantageous to accept cargo.

The currently sanctioned regimes of Iran, North Korea, Venezuela and Russia are success stories in the sense that it remains a buyers market inclined to accept sanctioned fuel at prices lower then that prevailing in the open international markets.

Poor versus Affluent Countries Syndrome

Poor versus Affluent Countries Syndrome

Lack of conviction about the rationale of sanctions as developing countries may identify with the countries sanctioned against combined with the relative tenacity required to monitor sanction violations suits the targeted countries.

Insurers are in the business of insuring and there is a limit to conducting due diligence of prospective clients despite vociferous demands of underwriters with the reality of existence of a shadow economy. Cargo originating from a sanctioned source costs less then that procured through formal and legitimate.

Indemnity becomes Nationalized

Intriguingly countries being the target of sanctions have a ready made solution to insurance matters as despite the phantom flotilla being unable to obtain commercial insurance and substantial and associated risks involved they arrange the insurance for official vessels willing to transport hazardous cargo like oil .

In a manner of speaking the targeted countries have a parallel system of P&I meaning shipping property indemnity and insurance .

This is corroborated by the initiative this year of the Russian National Reinsurance Company indemnifying official Russian ships.

In November 2022 a tanker laden with 284,000 metric tons of crude and carrying the flag of Djibouti grounded in the proximity of the Indonesian coast with fingers pointing to a long running clandestine trade from Iran yet indemnification appeared to be Iran’s version of P&I .

Tipping Scales

As P&I insurance policies typically extend over a one year period shipping companies have to choose whether to be part of the commercially insured fleet that complies with Western sanctions or to ship goods sanctioned by the West to countries without such sanctions under insurance provided by the Russian or Iranian companies. Phantom fleets remain oblivious and unaffected by insurance requirements and are bereft of any legal cover.

The tipping scale for Greek’s shipping companies will be its continuation of clandestine trade after the 5th of December 2022 and the Greek authorities commitment to abide with the US and EU sanctions regime against Russia. What remains to be seen is to what extent the Russian hydrocarbon industry will utilize Russian flagged or sponsored and Russian insured vessels.

Referances

https://foreignpolicy.com/2022/11/23/how-greek-companies-and-ghost-ships-are-helping-russia/

https://www.unescap.org/sites/default/files/Pub_1988_Ch5.pdf

https://www.joc.com/maritime-news/container-lines/national-shipping-company-saudi-arabia

https://www.bahri.sa/en/about-bahri/about-us/

https://www.ship-technology.com/analysis/the-ten-biggest-shipping-companies-in-2020/

https://maritime-executive.com/editorials/russia-s-new-maritime-doctrine-hybrid-war-with-the-collective-west