Dr. Marwa El Morabet write to “eBlueeconomy” About : Letter of Credit

By: Dr. Marwa El Morabet

CEO of Al Dawlya Center for Translation and Studies

What is a Letter of Credit?

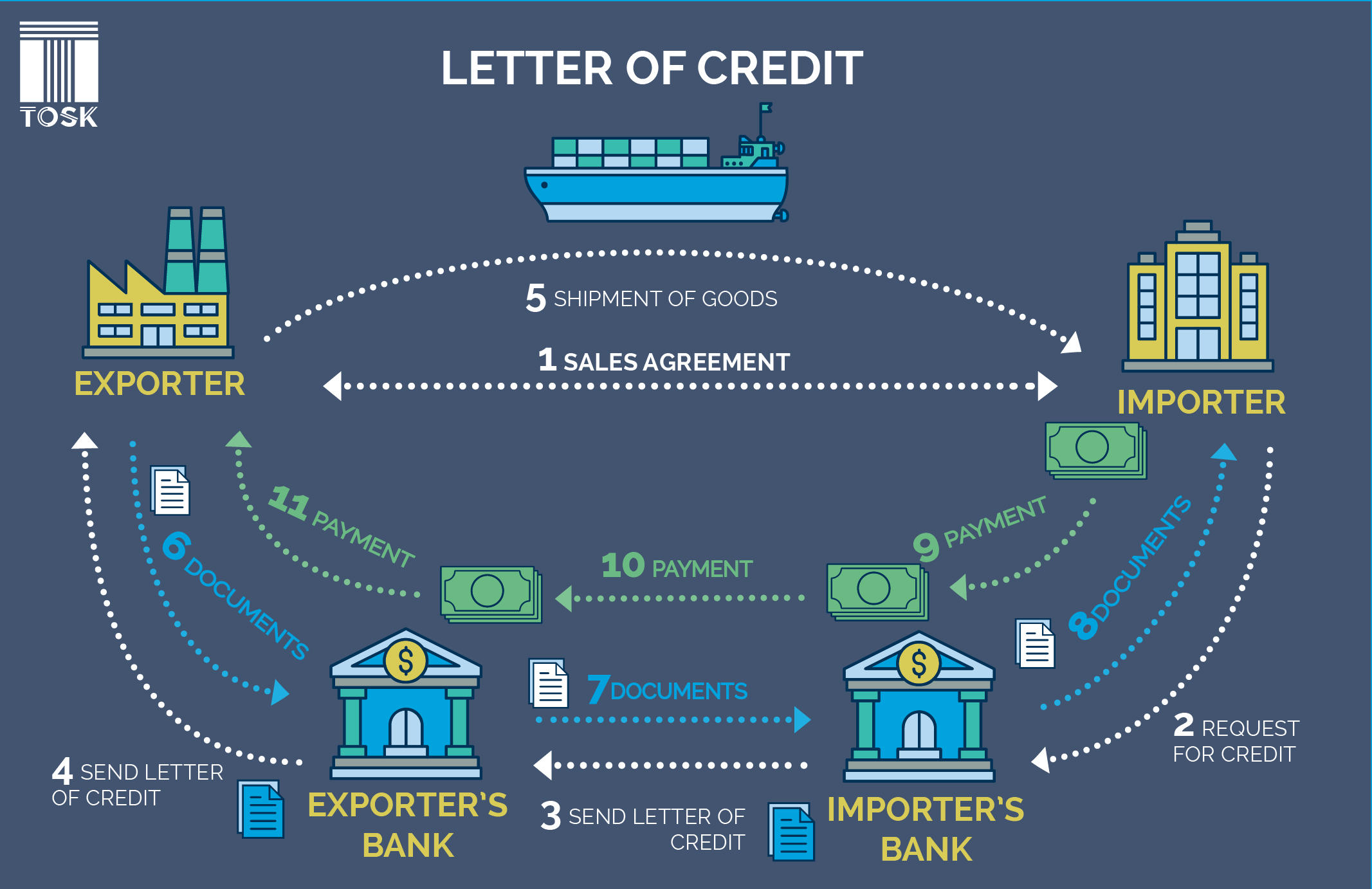

A letter of Credit or “Credit Letter” is a letter sent from a bank guarantying that a buyer’s payment to a seller will be received on time and for the same amount. In the event that the buyer is unable to make a payment on the purchase, the bank will be required to cover the full or remaining amount of the purchase. It may be offered as a facility. Letters of Credit are often used within the international trade or industry, thus, they are a tool for minimizing risk in international trade.

Essentially, a letter of credit is a financial contract between a bank, a bank’s customer, and a beneficiary. It is issued by an importer’s bank, the letter of credit guarantees the beneficiary will be paid once the conditions of the letter of credit have been met.

If you are an importer, using a letter of credit can ensure that your company only pays for goods after the supplier has provided evidence that they have been shipped, as well as, it allows you to conserve your cash flow since you don’t have to make any advance payments or deposits to the exporter.

Finally, the letter of credit gives you instant credibility with an exporter by demonstrating your creditworthiness.

If you are an exporter, the letter of credit is insurance in case the buyer fails to pay for goods you shipped. In such a case, the financial institution ( Bank) will cover the amount outstanding. The letter of credit also protects you against legal risks since you are ensured payment as long as delivery conditions have been met.

The beneficiary is the exporter, otherwise known as the seller or supplier of the goods.

What is a discount rate?

A letter of credit may have a discount rate. That means that the buyer may not have been the one to close the deal with the seller. Perhaps, it was arranged by a broker or the buyer’s agent. In that case, the difference between the actual amount available for purchase and the full value of the letter of credit is the commission earned by the broker.

A letter of credit is a protection for the buyer also if you pay somebody to provide a product or service and they fail to deliver, you might be able to get paid using a letter of credit. That payment can be a penalty to the company that was unable to perform and has to refund.

The bank will only issue a letter of credit if the bank is confident that the buyer can pay. Some buyers must pay the bank upfront or allow the bank to freeze funds held at the bank. Others might use a line of credit with the bank, effectively getting a loan from the bank.