Cruise Ship NewsHomeNews

Cruising :Norwegian Cruise Line Holdings Reports Second Quarter 2021 Financial Results

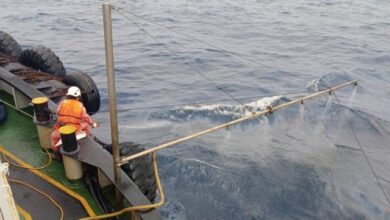

Great Cruise Comeback Commenced with Norwegian Jade Cruising in the Greek Isles

Norwegian Encore to Set Sail to Alaska from Seattle as Company’s First Cruise in the United States Since the Global Voyage Suspension in March 2020

MIAMI, : (GLOBE NEWSWIRE) — Norwegian Cruise Line Holdings Ltd. (NYSE: NCLH) (together with NCL Corporation Ltd., “Norwegian Cruise Line Holdings”, “Norwegian” or the “Company”) today reported financial results for the second quarter ended June 30, 2021, and provided a business update.

“Last week we reached a historic milestone in our Great Cruise Comeback with the successful commencement of our relaunch with the first ship in our fleet,

Norwegian Jade, sailing the Greek Isles. Tomorrow will mark our first cruise in the United States in over 500 days as Norwegian Encore sets sail from Seattle to Alaska,” said Frank Del Rio, president, and chief executive officer of Norwegian Cruise Line Holdings Ltd.

“As we recommence operations, we are putting health and safety at the forefront with our robust, science-backed SailSAFETM health and safety program, including our 100% vaccination policy which applies across all voyages on our three brands. We are ready and eager to welcome guests back on board and continue to see incredible strength in our booking trends for future cruises.

Our team is working tirelessly to execute our plan to return our full fleet to operation by April 2022 to capitalize on this unparalleled pent-up demand.”

Health and Safety

The Company is committed to protecting the health and safety of its guests, crew, and communities visited and has developed SailSAFE, a robust, science-backed health, and safety program that creates multiple layers of protection against COVID-19. The SailSAFE health and safety program is informed by expert guidance from the Healthy Sail Panel and the Company’s SailSAFE Global Health and Wellness Council.

As part of this program, all voyages will operate with fully vaccinated guests and crew in addition to comprehensive SailSAFE protocols, which include universal COVID-19 testing prior to embarkation.

The Company’s 100% vaccination policy applies across all voyages on its three brands as it believes this is the safest way to resume cruising in the current global public health environment. These measures will be continuously evaluated and modified as science and technology evolve.

Resumption of Cruise Operations

The Company has announced its phased relaunch plans for all 28 ships across its three brands which began with Norwegian Jade on July 25, 2021, and continues through April 1, 2022.

The first cruise to commence in the United States is scheduled on August 7, 2021, with Norwegian Encore sailing to Alaska from Seattle.

The Company expects to have approximately 40% of its fleet capacity operating by the end of the third quarter of 2021 and approximately 75% by year-end 2021 with the full fleet expected to be back in operation by April 1, 2022.

The Company’s current plans include a re-start of operations from Florida beginning on August 15, 2021, aboard Norwegian Gem sailing from Miami.

The Company has been unable to reach a mutually agreeable solution with the State of Florida that would allow it to require documentation confirming guests’ vaccination status prior to boarding cruises from Florida.

As such, the Company has asked the U.S. District Court for the Southern District of Florida to invalidate Florida’s prohibition and to grant a preliminary injunction to allow the Company to resume sailing in the safest way possible with stringent health and safety protocols to minimize, to the greatest extent possible, further spread of COVID-19.

A hearing on the motion for preliminary injunction is scheduled for today, August 6, 2021, and the Company hopes to receive additional clarity shortly on its path forward to resume sailing from Florida.

The ruling has no impact on sailings outside of Florida where the Company’s policy of 100% vaccination of guests and crew is in place without issue in every other port it sails from around the world.

Booking Environment and Outlook

Bookings continue to be strong for future periods despite reduced sales and marketing investments and a travel agency industry that has not been at full strength since the start of the pandemic.

2022 booking and pricing trends continue to be very positive driven by strong pent-up demand. The Company is experiencing robust future demand across all brands with the overall cumulative booked position for full-year 2022 meaningfully ahead of 2019’s record levels at higher pricing even when including the dilutive impact of future cruise credits (“FCCs”).

The Company’s advance ticket sales were $1.4 billion, including the long-term portion, which includes approximately $800 million of FCCs as of June 30, 2021.

Liquidity and Financial Action Plan

The Company continues to take decisive measures on its financial action plan to enhance liquidity and control costs in the current environment. As of June 30, 2021, the Company’s total debt position was $12.3 billion and the Company’s cash and cash equivalents were $2.8 billion.

The Company has taken the following additional actions to enhance its liquidity since March 31, 2021:

-

In July 2021, the Company amended nine credit facilities for its newbuild agreements and increased the combined commitments under such credit facilities by approximately $770 million to cover owners’ supply and modification costs and financing premium fees.

-

Secured a €28.8 million loan facility for newbuild related payments.

-

Requested and received approval from its shareholders for an increase of 490 million authorized ordinary shares at the Company’s annual general meeting.

The Company’s monthly average cash burn for the second quarter of 2021 was approximately $200 million, higher than prior guidance of approximately $190 million and above the prior quarter, as it prepared for a return to service this summer.

Looking ahead, the Company expects third quarter 2021 monthly average cash burn to increase to approximately $285 million driven by the continued phased relaunch of additional vessels. This cash burn rate does not include expected cash inflows from new and existing bookings.

Cash burn rates include ongoing ship operating expenses, administrative operating expenses, interest expenses, taxes, debt deferral fees, and expected non-newbuild capital expenditures and exclude cash refunds of customer deposits as well as cash inflows from new and existing bookings, newbuild related capital expenditures, and other working capital changes. Future cash burn rate estimates also exclude unforeseen expenses.

The second quarter 2021 cash burn rate and third-quarter estimate also reflect the deferral of debt amortization and newbuild-related payments.

“We are focused on the flawless execution of our return to service plan including the phased relaunch of all 28 of our vessels by April 2022 which is the first step on our road to recovery,” said Mark A. Kempa, executive vice president, and chief financial officer of Norwegian Cruise Line Holdings Ltd. “Recognizing that the global public health environment remains fluid, we continue to focus on controlling costs, balancing our cash needs and enhancing our liquidity position to maintain financial flexibility.”

Second Quarter 2021 Results

GAAP net loss was $(717.8) million or EPS of $(1.94) compared to a net loss of $(715.2) million or EPS of $(2.99) in the prior year. The Company reported Adjusted Net Loss of $(714.7) million or Adjusted EPS of $(1.93) in 2021 which included $3.1 million of net adjustments. This compares to Adjusted Net Loss and Adjusted EPS of $(666.4) million and $(2.78), respectively, in 2020.

Revenue decreased to $4.4 million compared to $16.9 million in 2020 as voyages were once again suspended for the entire quarter.

Total cruise operating expense decreased 17.2% in 2021 compared to 2020. In 2021, cruise operating expenses were primarily related to crew costs, including salaries, food and other travel costs, fuel, and other ongoing costs such as insurance and ship maintenance.

Fuel price per metric ton, net of hedges increased to $673 from $594 in 2020. The Company reported a fuel expense of $54.1 million in the period.

Interest expense, net was $137.3 million in 2021 compared to $114.5 million in 2020. The increase in interest expense reflects additional debt outstanding at higher interest rates, partially offset by lower LIBOR. Included in 2020 were losses on extinguishment of debt and debt modification costs of $21.2 million.

Other income (expense), net was income of $25.5 million in 2021 compared to an expense of $(14.4) million in 2020. In 2021, the income is primarily related to gains on fuel swaps not designated as hedges.

2021 Outlook

As a result of the COVID-19 pandemic, while the Company cannot estimate the impact on its business, financial condition or near- or longer-term financial or operational results with certainty, it will report a net loss for the third quarter ending September 30, 2021 and expects to report a net loss until the Company is able to resume regular voyages.