Allianz: total losses in the maritime sector are decreasing but war and large ships are worrying

Allianz Global Corporate & Specialty SE has just published the usual Safety & Shipping Review 2022 which shows that last year the shipping sector maintained its positive trend in long-term safety, but the Russian invasion of Ukraine, the growing number of major cost issues affecting large ships, the challenges for crews and port congestion resulting from the increase in shipping, together with the management of challenging decarbonization goals, leave no room for peace of mind.

![]()

“The transport sector has shown tremendous resilience over the past difficult years, as evidenced by the boom we are witnessing today in various sectors of the industry,” said Captain Rahul Khanna, global head of marine risk consulting at Allianz.

“Total losses are at an all-time low, or about 50-75 per year in the last four years compared to over 200 per year in the 90s. However, the tragic situation in Ukraine has caused widespread problems in the Black Sea and elsewhere, aggravating the situation of the supply chains already under pressure and also the already existing inconveniences caused by the Covid-19 pandemic, the congestion of ports, and the problems related to the change of crews.

At the same time, some of the responses put in place to support the increase in sea transport, such as modifying the use or extending the working life of ships, raise some concerns. The growing problems posed by large ships, such as fires, grounding, and complex rescue operations, continue to represent a challenge for owners and their crews ”.

Agcs’ annual study analyzes reported shipping losses and incidents (accidents) for ships over 100 gross tons. In 2021, 54 total ship losses worldwide were reported, compared to 65 the previous year. This represents a 57% decline in 10 years (127 in 2012), while during the early 1990s the world fleet lost more than 200 ships per year.

The reduction in total losses in 2021 is made more impressive by the fact that there are around 130,000 ships in the world fleet today compared to around 80,000 30 years ago.

“This advance reflects the increased focus on protective measures through training and safety programs, improved ship design, technology and regulation,” the report explains.

There have been almost 900 total losses in the last ten years (892). The maritime region of southern China, Indochina, Indonesia, and the Philippines in the area with the highest number of total losses, with one in five in 2021 (12) and one in four in the last decade (225), a consequence of the high concentration of trade in those areas, congested ports, older fleets, and extreme weather conditions. Worldwide, cargo ships (27) represent half of the ships lost in the last year and 40% in the last decade.

The shipwreck (sinking/submersion) was the main cause of the total losses in the last year, equal to 60% (32).

While total losses have declined over the past year, the number of reported shipping accidents has increased and the British Isles recorded the majority (668 out of 3,000). Damage to machinery accounted for more than one in three accidents globally (1,311), followed by collisions (222) and fires (178), with the latter increasing by nearly 10%.

Impact of Ukraine: safety and insurance coverage

The maritime industry has been hit on several fronts by the Russian invasion of Ukraine, with the loss of life and ships in the Black Sea, the disruption of trade, and the growing burden of sanctions.

But it also faces challenges to day-to-day operations, with ripple effects for the crew, fuel cost and availability, and the potential and growing cyber risk.

The invasion has further consequences for a global maritime industry that is already facing various shortcomings. Russian seafarers represent just over 10% of the world’s labor force of 1.89 million people, while about 4% come from Ukraine.

This personnel may find it difficult to return home or to reach the ships at the end of the contracts. A protracted conflict could have deeper consequences, potentially reshaping the global trade in energy and other commodities.

An extended embargo on Russian oil could help raise the cost of fuel and impact its availability, prompting shipowners to use alternative fuels. If these were of substandard quality, it could lead to future claims for machine breakdowns.

In this scenario, security agencies continue to warn of an increased prospect of cyber risks for the maritime sector such as GPS blocking, automatic identification system (AIS) spoofing, communications problems, and electronic interference.

The insurance industry will likely see a number of warfare claims from ships damaged or lost due to sea mines, missile strikes, and bombing in conflict zones” explains Justus Heinrich, global product leader – marine hull by Allianz. “Insurers may also receive compensation claims under marine policies with war risk extension for ships and cargoes blocked or trapped in Ukrainian ports and coastal waters.”

The series of sanctions against Russian interests presents a considerable challenge. Violating sanctions can have severe repercussions, but compliance with them can also be a considerable burden. It can be difficult to determine the ultimate owner of a ship, cargo, or counterparty.

Sanctions also apply to various parts of the transportation supply chain, including banks and insurance, as well as maritime support services and all make compliance even more complex.

Obstacles in shipments and congestion of ports

Measures due to Covid-19 in China, a surge in consumer demand, and the invasion of Ukraine have all been factors in unprecedented port congestion that puts crews, port managers, and facilities under further pressure.

“Loading and unloading ships is a particularly risky operation, for which even small errors can have big consequences. Container ports are becoming increasingly crowded and have little space, while the skilled manpower needed to properly handle containers is in short supply. If you add the fast turnaround times, the result can be a high-risk environment, ”Heinrich explains.

Climate change: transition problems

The report notes that the momentum and international efforts being made to tackle climate change are putting the maritime sector under increasing pressure to accelerate its commitment to sustainability, as related greenhouse gas emissions have grown by about 10. % between 2012 and 2018.

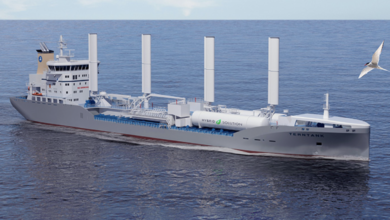

Decarbonization will require large investments in green technology and alternative fuels. An increasing number of ships are already switching to liquefied natural gas (LNG), while some other fuels, including ammonia, hydrogen, and methanol, are under development, as are electrically powered ships.

The transition to alternative fuels is likely to lead to increased claims for machinery breakdowns as new technology settles and crews adapt to new procedures.