Breakwave Dry Bulk Shipping Report

The prospects for 2021 start to look

promising. Vale, the Brazilian miner, remains optimistic

Vaccine news should boost sentiment in an otherwise dull market – Yesterday’s news about the successful trials of a COVID-19 vaccine led to significant rallies in risk assets across the globe, as hope for a return to normalcy in the foreseeable future provided some much needed confidence for investors. For dry bulk this is also welcoming news, although, in reality, China, which has been the major source of dry bulk demand this year, has already been running at very high levels when it comes to commodity-related activity.

Iron ore imports into the country will reach a new all-time high this year, while grains imports to China should also hit multi-year highs. Coal imports remain below last year’s level, but this is mainly due to the established quotas as well as the ongoing trade dispute between China and Australia.

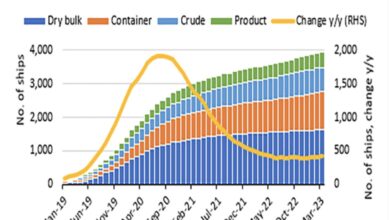

Once the quotas reset next year, we expect imports to resume at a very strong run rate, at least in the first half of the year. However, sentiment is as important as fundamentals when it comes to shipping, and with the vaccine news providing some optimism about the future, shipping should also see a similar recovery in sentiment. Spot rates remain low for this time of the year, and in our view, there is still significant amount of iron ore to be shipped from Brazil while seasonality calls for another rally before the year is over, though from a much lower base. Currently Capesize spot rates are averaging about 15,000 while Panamax spot rates are ~9,000.

Australia-China trade tensions something to watch

Australia-China trade tensions something to watch – The recent trade friction between Australia and China is by no means welcoming news for shipping. China is Australia’s largest trade partner, and seaborne shipping is the trade link between the two countries.

Although not officially confirmed by either party, coal trading has been hit hard already, while trading in other smaller commodities also seems to be affected.

The elephant in the room, namely iron ore, has not been affected so far. Given the importance of the steel-making material to both countries, we would expect that to be off the table, for now. However, given the recent years’ realized trade wars, one should not take such inaction for a given.

China is definitely trying to diversify its future iron ore supply (see Simandou), and although we think in the near term the iron ore trade will remain unaffected, the risk increases as China secures supplies from further away. Such a development, if materialized gradually over time, is quite bullish for shipping as it increases the tonne-mile demand, but any abrupt disruption in a trade before

that will be very negative for dry bulk

Freight futures remain skeptical of such scenarios

starts 2021 to look attractive – With less than two months till yearend, the prospects for 2021 start to look promising. Vale, the Brazilian miner, remains optimistic about raising their production by some 30-40 million tons, a development that should provide a significant boost to ton-mile demand. Iron ore prices remain above $100/ton, a very strong incentive for miners around the world to produce and ship as much as possible of the steelmaking material.

The potential for other regions to reopen their economies (India, Europe, etc.) can provide an added boost. Freight futures remain skeptical of such scenarios, trading at significant discounts to current spot levels, especially for Capsizes. We view such price-fundamentals disconnect as an opportunity

press release